how to become cpa lawyer

Ask for an Enrolled Agent designation legal license or CPA. Our team will review your message and we will get in touch with you soon.

What Is A Cpa And How Do I Become One Coursera

In addition you must meet one of the following criteria.

. The lawyer abbreviation LLM. Career Trend is the ultimate companion for your professional journey. A retainer fee is most.

Search friends in high places. CPA Chairman Ian Pairaudeau CNS. The ALA supplies a host of tools built specifically for the fields of accounting and law which save time money and also build specialty knowledge and.

IRS Special Agent Salary and Job Outlook. This polishes them to become market specialists that offer sound advice on a. A power of attorney POA or letter of attorney is a written authorization to represent or act on anothers behalf in private affairs which may be financial or regarding health and welfare business or some other legal matter.

The key question is whether the lawyer can deal with it and bounce back in the future. A retainer fee is an upfront cost incurred by an individual in order to pay for the services of a consultant freelancer lawyer or something similar. Become a Member Join a Division News Updates.

The idea that a CPA malpractice claim can happen to any firm that engages in accounting is not a false one. A LAWYER working for the Cebu Port Authority CPA and her son were wounded in an ambush conducted along a major road in Mandaue City Cebu Thursday evening Sept. Are a CPA a CFP an EA a lawyer or have another professional license issued by a state agency.

At a meeting on Tuesday afternoon 30 August the Central Planning Authority CPA resolved to appeal the decision by Justice Alistair Walters regarding the power of the National Conservation Council to direct planning refusals in certain circumstances. The one authorized to act is the agent attorney or in some. 1 2022The Mandaue City Police Office MCPO identified the lawyer as Karen Quiñanola-Gonzales head of CPAs Business and Marketing DepartmentGonzales and her 19-year-old son were.

In this NFIB webinar CPA and Balance CFO Jamie Trull joined Beth and Holly to give a deep dive on the ERC. Get A Tax Lawyer GATL is the Nations Leading Tax Law Firm specializing in tax planning tax resolution and litigation. Your message was sent.

Every lawyer will experience failure at some point. Or SJD is the equivalent of a PhD. A Doctor of the Science of Law JSD.

Membership in the CPA grants you access to a network of resources information thought leadership best practices and business guidance to help you throughout your career wherever it takes you. Most state bar associations require candidates to hold degrees from ABA-accredited law schools to take the bar exam and obtain licensure. JD degree holders without a taxation designation can still become tax attorneys but they should complete significant coursework covering tax and business topics.

Ciloscos said the. People who take the course include anyone whos got a heart for serving otherslike Financial Peace University coordinators stewardship pastors small-group leaders anyone already working with financially hurting families and CPAs and financial advisors who want to add to. Take the first step to become a better you.

A commitment to improving. What to look for in an answer. Attorneys who get these lawyer initials generally become scholars or teachers of law and social sciences.

Texas Comptroller of Public Accounts Unclaimed Property Division Research and Correspondence Section PO Box 12046 Austin TX 78711-2046 Telecommunications Device for the Deaf TDD 1. 1 Those who work for the federal government earn a substantially higher average at 61880. The national average salary for a corporate lawyer in the United States is 130857 per year although your years of experience education skill set and geographical location can affect your salary.

Key Areas of Interest for Physiotherapy Professionals. Explore top career options training programs and expert-written resources. To become an RSSA you must demonstrate knowledge in basic and advanced Social Security concepts by passing the RSSA Competency Final Exam.

Salaries for IRS special agents are based on experience education and time-in-service. According to the Bureau of Labor Statistics tax examiners collectors and revenue agents earn an average annual salary of 54440. Financial Coach Master Training is ideal for passionate people who want to help others with their money.

The person authorizing the other to act is the principal grantor or donor of the power. Resilience to deal with failure. The CPA profession has a high exposure to lawsuits and liability for a multitude of reasons.

Police Captain Armil Coloscos chief of Station 4 of the Mandaue City Police Office confirmed that Quiñanola-Gonzales is a lawyer working for the Cebu Port Authority CPA. For example the average salary for corporate lawyers in New York New York is 186861 per year while the average salary for the same position. Is often obtained by international lawyers who want to earn global credentials.

If you have any immediate concerns please call 1-844-339-6334. The Boggy Sand case pitched two government entities against each. To become a successful financial controller the candidate must first have a minimum of a bachelors degree in accounting.

Do you a comparative analysis of fees. On the long winding road toward career success there are many bumps and detours everything from your grueling first job to a complete shift in career paths. If you are an accountant or legal professional who has questioned the real value of the membership association you are a part of please consider joining the Accountant-Lawyer Alliance ALA.

The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 220 while the average fee for an itemized Form. Any other degree over and above it such as CPA masters degree etc will be a big boon not just to you but for the company also where you will be working in as you will have in-depth knowledge about the work. Jamie covered everything a small business needs to know on the Credit including what are qualifying wages eligibility criteria and flowcharts examples of ERC calculations for 2020 and 2021 qualifying businesses and the interplay.

Greene is a founding partner of McGovern Greene LLP a forensic accounting and litigation services consulting firm. Find a New Career. A good lawyer will learn from failure and make the necessary adjustments so it does not happen again in the future.

The Power Of The Dual View Cpas Should Consider A Law Degree

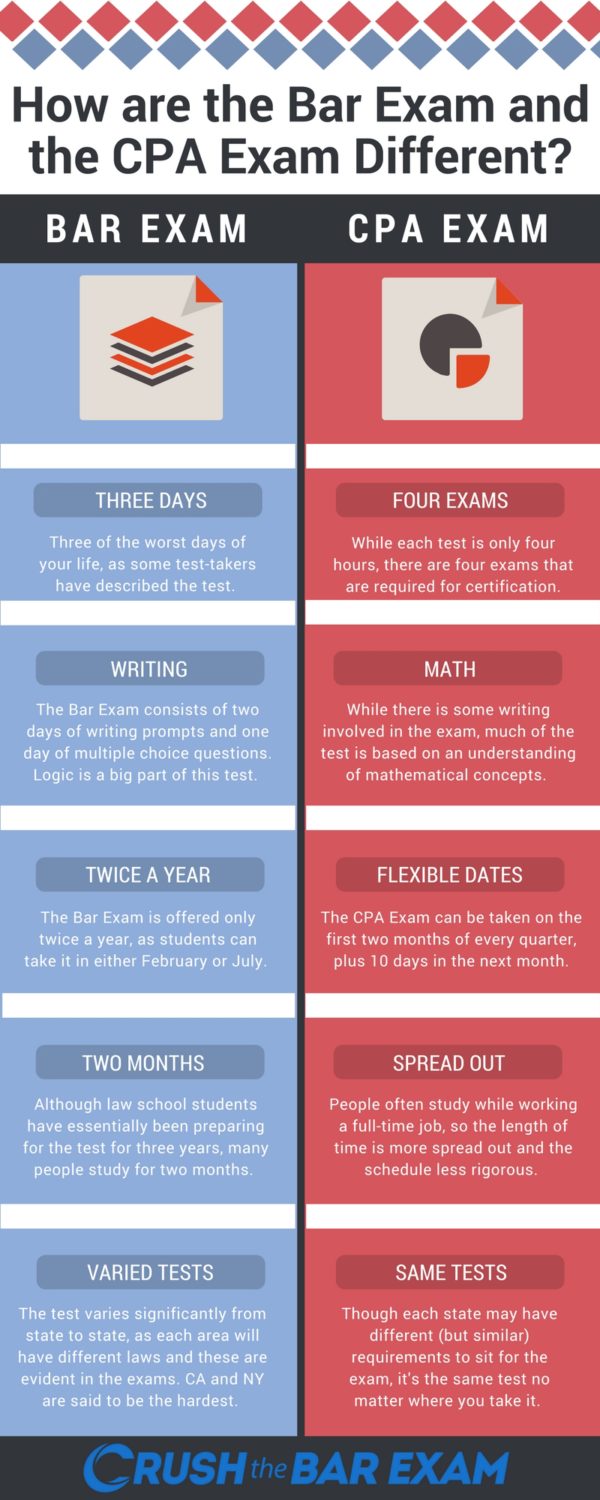

Cpa Exam Vs Bar Exam Which One Is Harder Crush The Bar Exam 2022

Cpa Lawyer Shares Advice From Uncommon Career Path Mays Impacts Mays Business School

San Jose Tax Attorney And Cpa David Klasing

Differences Between Cpas And Tax Attorneys Milikowsky Tax Law

/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

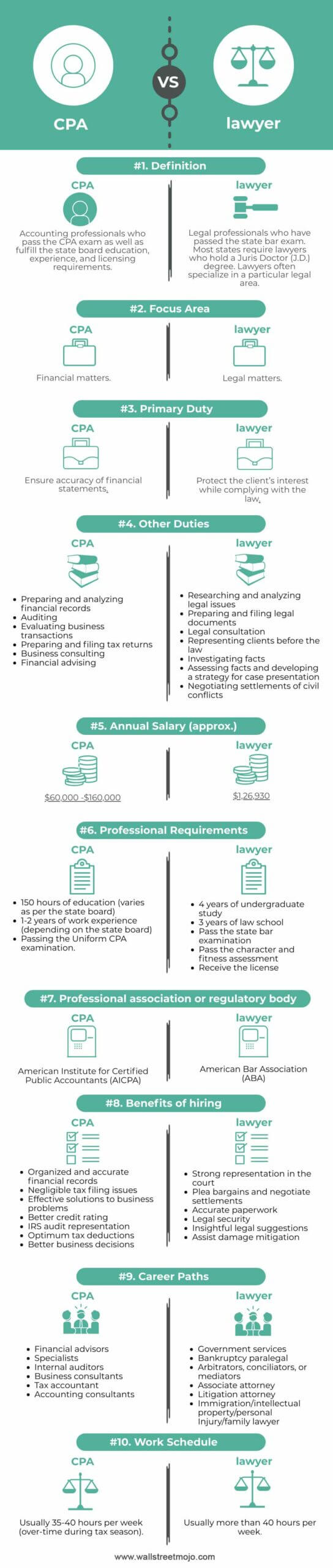

Cpa Vs Lawyer Top 10 Best Differences With Infographics

The Power Of The Dual View Cpas Should Consider A Law Degree

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Is Studying To Become A Cpa Similar To Studying For The Bar To Be A Lawyer

5 Disadvantages Of Being An Accountant Cpa Traceview Finance

7 Skills Cpas Need And How To Get Them Robert Half

How To Become A Lawyer Accountant

Can I Combine An Accounting Degree With A Law Degree Top Accounting Degrees

![]()

How To Become A Lawyer Crush The Bar Exam 2022